In a bid to raise online safety awareness, Safer Internet Day is taking place on 5 February this year – falling on the same day as the first day of Lunar New Year. This campaign is a call to action for all stakeholders to join together and play their part in creating a better internet for everyone, and especially for younger users.

According to a Google survey, 2 out of 3 Singaporeans head online to prepare for this 15-day celebration. Google also released insights into how Singaporeans are using Search and YouTube to celebrate this festive season.

While shopping online is convenient, it carries a certain degree of risk if we don’t stay vigilant especially with the recent spate of e-commerce and phishing scams we see on the news. According to the Singapore Police Force, e-commerce scam cases jumped 58 per cent in 2018.

Recent incidents such as Collection #1 had 772,904,991 unique email addresses being exposed. This increasing trend of data breaches occurring around the world is worrying. Certainly, Singaporeans are at risk too.

As such, the following guide that has been kindly curated by Google will hopefully serve as a starting point for all users of the internet.

Tips to stay safe online

1. Protect your online shopping accounts

Most of us create multiple accounts when accessing e-commerce platforms to purchase items, and these accounts often contain sensitive information, like your contact details and credit card information.

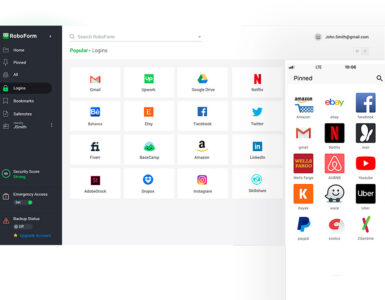

Make sure you choose a strong, unique password that’s at least eight characters long, and use a different password for every account so that if one account is hacked, your other accounts aren’t compromised.

And should you ever get logged out of your account and need to quickly regain access, adding recovery information like a phone number or email address will definitely be helpful!

2. Download secure apps

The festive season brings brisk business for e-commerce sites who might prompt you to download their dedicated shopping app for a better shopping experience.

Just be aware of any fake shopping apps that set out to steal your personal information.

To prevent that, make sure you’re downloading apps from trusted sources like the Google Play Store which scans all apps for malware before and after you install them.

3. Beware of phishing when surfing online

Phishing cases are on the rise and spotting them can be a challenge, even for savvy web users. It is important to learn how to spot suspicious emails and websites, preventing yourself from revealing critical personal information such as your password.

To avoid being a victim of phishing attacks:

- Never click on questionable links

- Always double-check the URL to make sure the browser shows a lock symbol to ensure that you’re entering your data into a legitimate website

- Before submitting any information, make sure that the site’s URL begins with ‘https’ (versus “http”), meaning it’s secure

Use web browsers which have security steps in place to keep users away from phishing sites. For example, if you visit a site with malware or attempts to phish you, you’ll be warned by Chrome and taken back to safety. Or if you type your Google account password into a suspected phishing site, Chrome will surface a warning and add protections to ensure your account isn’t compromised.

Test your phishing-detection skills:

4. Beware of offers that sound too good to be true

Online marketplaces are a great place to get the best bargains for the festive season. But do think twice about that great bargain you’ve spotted, especially if it sounds too good to be true.

To prevent yourself from falling victim to an e-commerce scam, here are some easy steps to follow:

- Always check the seller’s score and track record, and only purchase from reputable sellers

- Use shopping platforms that release payments to the seller after you have received the goods

- With millions of buyers online selling products, you can look to secure sites such as Google Shopping to surface merchants who meet a minimum review score so you’ll know they’re safe.

5. Use Google Pay for more secure payment

Stolen credit card information is a common concern during the holidays, whether you are shopping at a store or online.

Google Pay technology is much safer than using your credit card; here’s why:

- When you add a credit card to Google Pay, your bank creates a random sequence of numbers that corresponds to your card.

- This is called a ‘token’. It is stored, encrypted, on your phone.

- When you pay for stuff with Google Pay, the app uses this token instead of the credit card number itself.

- Even if a bad person is ever able to access the token, it will just appear as a random number string and will be useless to them.

- Additionally, critical transaction information associated with the token expires after a brief period of time.

- And even if you lose your phone, you can remotely lock or erase all information from your device using “Find My Device”.

🤓 Like what you read?

Stay updated by following us on Telegram, Facebook, Instagram or on our YouTube channel.