The introduction of virtual credit cards promised many benefits – from fund security to purchase privacy. As the popularity of e-commerce sites continues to increase exponentially, many users are now appreciative of the extra protection these cards provide.

These benefits could also be seen as a double-edged sword as it restricts the customer’s access to several incentives and support. This article discusses the benefits and limitations of a virtual credit card.

Added privacy with randomised card numbers

Phishing sites could capture your credit card number and CVV of your card when you input your account details. Given that virtual credit cards come in randomised numbers that can be changed frequently, there is no chance of repeated use of the same card. Banks issuing your card will only have a “top-up” reflected under the transaction rather than the full transaction details.

Some cards even work on a one-time use basis, meaning that the card number will be void after each transaction. This drastically decreases the likelihood of credit card thieves using the card for other transactions.

Fraud control and budget control

Most virtual credit cards work on a pre-paid basis – you only top-up the exact amount you intend on utilising. Should malicious parties ever gain access to the virtual card, you would not lose more than what you have topped up.

The virtual card also solves the common overspending qualm associated with online shopping, caused by impulsive online purchases. Having users top-up their cards right before paying might help some buyers rationalise their purpose before making that payment. Rather than making multiple purchases endlessly, such a card can encourage users to stick to their budget.

No credit card loyalty and after-sales

The major benefit of a virtual credit card (such as providing data privacy) could be a double-edged sword, especially when settling after-sales matters relating to a transaction. Unlike a transaction done with a bank card, it is much harder to verify your identity since the card expires after the transaction.

The disposable nature also limits the loyalty benefits that regular bank cards can receive, such as rebates and bank-specific privileges. Privileges that come with bank-issued cards can also be stacked together, amounting to huge incentives.

Limited support on selected sites

Apps providing on-demand services, such as ride-hailing apps, may not support virtual credit cards. You will be limited to bank cards in such cases, leaving a transaction record with the bank. This rule could also apply to other apps that charge you after the transaction.

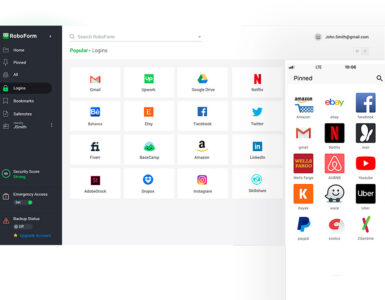

Virtual credit cards cannot be used in conjunction with Apple Pay or other payment services such as

Your privacy might outweigh the extra privileges

One significant benefit of e-commerce shopping is the sense of privacy, and shoppers who value autonomy can easily overlook the drawbacks in favour of Virtual Credit Cards.

Rebates and miscellaneous privileges offered by a bank card could be more attractive for the average online shopper. In such cases, keeping your browser and networking environment secure could be a more feasible method. Apart from online transactions, read this article to find out how the Google Chrome browser can keep users safe while browsing the internet.

🤓 Like what you read?

Stay updated by following us on Telegram, Facebook, Instagram or on our YouTube channel.