Whilst we leave 2023 behind, scammers on the internet have yet to concede defeat in terms of their scamming practices. Starting with some astonishing figures from the Singapore Police Force (SPF), the number of cybercrimes saw an increase of 69.4% from the first half of 2023, from 14,481 cases in the same period in 2022.

Scams are not ageist – they merely target the unaware population. Surprisingly, young adults (aged 20 to 39) made up more than half of the scam victims, despite being commonly referred to as digital natives.

This article will address the most prevalent scam types amongst the 22,339 cases that occurred in the first half of 2023 – a reference point we will be actively using in the rest of the article.

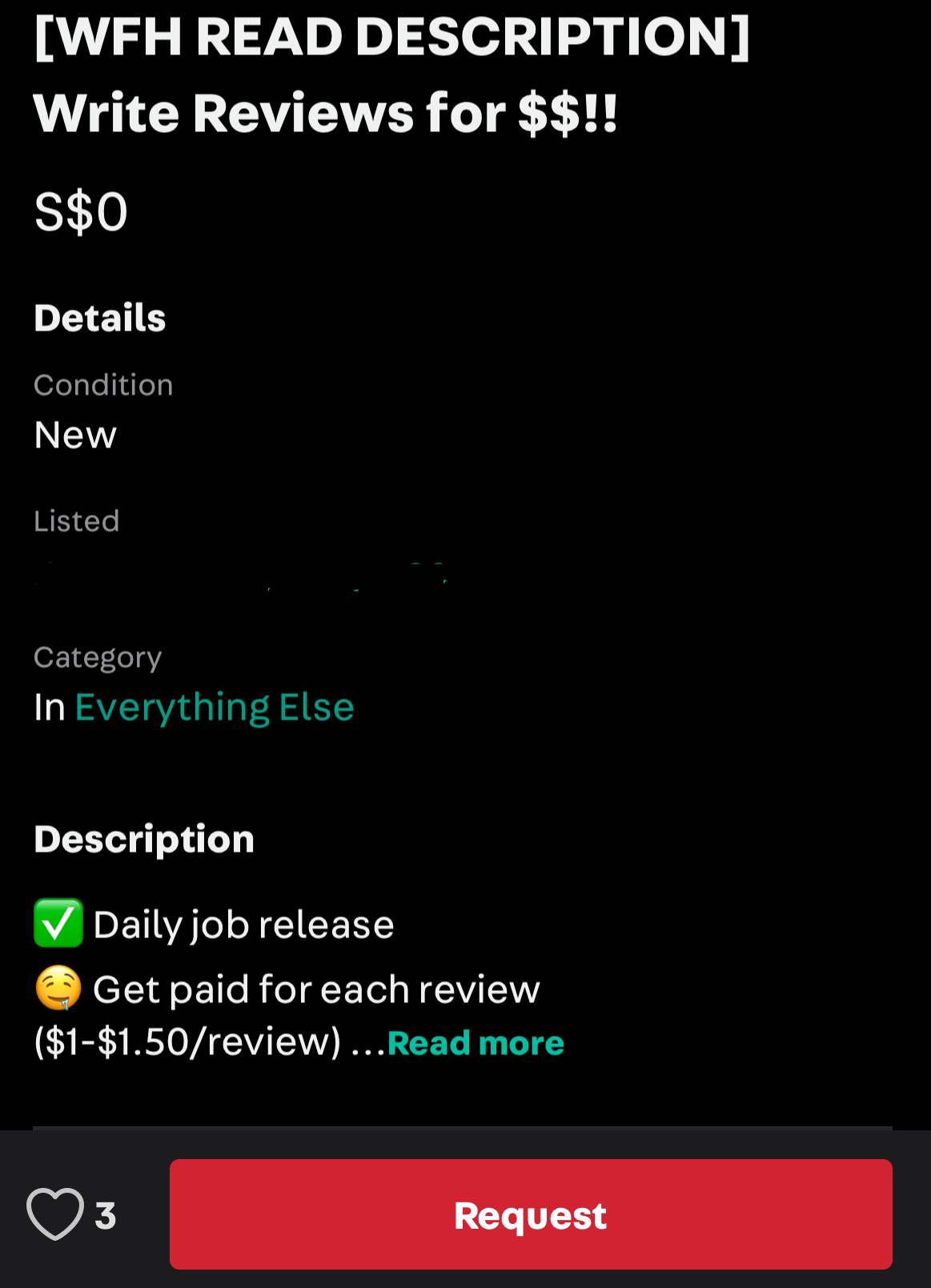

Job scams

Kicking off your New Year’s resolution with a side hustle? Work-from-home options sound like the perfect fit! Well, not if you are a part of the S$79.4 million total amount cheated in the specified timeframe.

Candidates would usually be asked to perform entry-level tasks such as making advance purchases, liking social media posts, forging online reviews for online merchants, completing questionnaires, ‘boosting’ the value of cryptocurrencies, or ‘rating’ mobile apps to improve their rankings on the platforms.

The red flag comes when victims are asked to transfer funds after creating an account on fraudulent websites. Victims will be initially baited by small commissions that they receive by transferring funds to bank accounts provided.

They would subsequently be instigated to transfer larger amounts – with no returns from scammers thereafter. The scammers will vanish from contact at this point. The most popular job scams takes place on WhatsApp and Telegram.

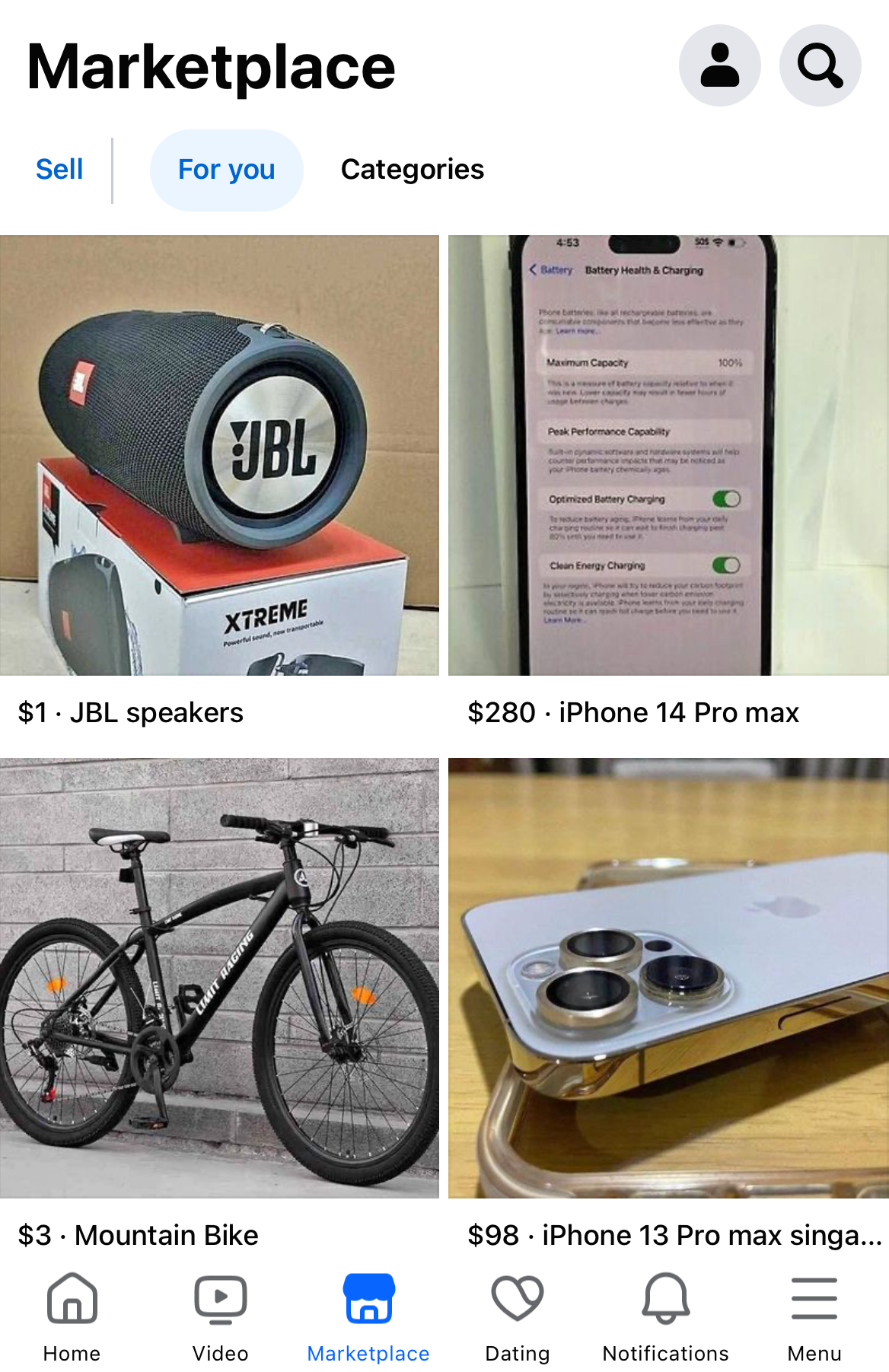

e-Commerce scams

Your hunt for a good deal might end up being a good catch for the scammers – the total amount cheated in the specified timeframe was S$7.3 million. These usually involve sales of goods and services without meet-up.

You might assume that this is thanks to the advancement in convenient courier services. Generally, victims would fail to receive the goods or services they requested after making payments.

Sellers are also not excused from such scams – scammers posing as prospective buyers might provide fake screenshots as “proof of payment”.

The breeding ground for these scams includes Facebook, Carousell and Telegram – commodities usually include rental of residential unit and electronic goods.

Friendly fire – fake friend call scams

Empathy is a virtue – which the scammers utilised to scam the 3,855 victims reported. This usually involves the scammers contacting victims via phone calls, impersonating their friend or acquaintance.

The scammers would use creative reasons to request money from their pals. Compassionate victims would transfer funds to unknown individuals – only to realise that their friends had yet to contact them, and still maintained their contact channels.

This scam applies to anyone regardless of their internet activity – the most common channels are phone calls and WhatsApp calls.

Phishing scams

Generally done by posing as trusted entities or officials, victims are often misled to produce their credit card or bank account information. These information, commonly obtained via phone calls or websites, would be used to perform unauthorised transactions.

Victims could either be convinced that they are being summoned by the Singapore Police Force (SPF) or the Ministry of Manpower (MOM), or be eager to sell off their items on Facebook or Carousell. Contrary to “popular belief”, government authorities will not request for your financial information – for verification purposes or paying a fine.

For the latter, scammers would usually send links or QR codes to complete the transaction – which leads to spoofed websites. They might request for the seller to pay a deposit for a courier to collect the item from the seller.

Investment scam

Motivated to start your investment portfolio, “investment opportunities” through internet searches or via recommendations from online friends might sound like a simple beginning. This led to to S$97 million in losses in the period.

Victims are commonly lured to “invest” – via methods of bank transfer to fraudulent bank accounts or cryptocurrency wallets. The initial, minor investment would usually yield small profits, gradually leading up to larger investments which could never be withdrawn.

To form the illusion of earnings, victims would be enticed to use fradulent websites or apps to display their purported returns from the investment. Facebook, Instagram and Telegram were the most common platforms.

Malware-enabled scams

Malware might be more prevalent than you think – more than 750 cases of phone malware were reported in the period. These malicious software might target funds such as withdrawals from the Central Provident Fund (CPF).

These apps creep in when victims install a seemingly innocent Android Package Kit (APK) under the pretext of payment for advertised services (i.e. home cleaning, food purchase, etc.). Another possibility could be via dating apps where the target is influenced to install an APK to video call, chat, or watch livestreams from the scammers.

These apps would obtain the victims’ interent banking credentials, card details or login information – and victims subsequently discover about unauthorised behaviour on their accounts.

“Cleaning apps” which might appears to be optimising your phone might also be secretly stealing your credentials. Some apps could also appear invisible on your phone’s home screen – only to be highlighted by your banking apps as malicious.

To find out more about malware-enabled scams, read this related article.

🤓 Like what you read?

Stay updated by following us on Telegram, Facebook, Instagram or on our YouTube channel.